Overview

What is Forex?

The forex or FX market, which is short for the foreign exchange market, is the place in which individuals, companies and governments all trade different currencies with one another. Put simply, the forex market is the marketplace where money is bought and sold.

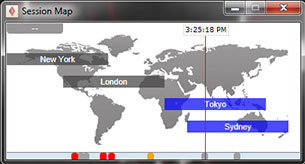

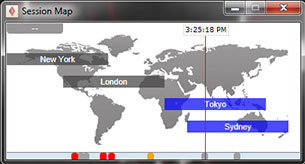

Open 24 hours a day and 5 days a week, unlike stock or bond markets, the forex market doesn’t close at the end of each day. Instead, trading just shifts to different financial centres around the world. The day starts with the Sydney session and moves to Tokyo, London, Frankfurt and finally New York before it is time for Sydney to do it all over again!

When compared to various stock, commodities and bond markets worldwide, the forex market is by FAR the biggest financial market in the world. The NYSE sees an average of $22.4 billion per day in volume traded, while the London Stock Exchange sees an average day turn over $7.2 billion in volume traded.

They sound like big numbers, don’t they? Well the forex market does an absolutely massive $5.3 TRILLION, monstering them all in comparison!

The most appealing thing about trading forex is just how accessible it is to trade for regular people like you! Known as ‘retail traders’, these are the people trading the forex market from their own homes with nothing more than a computer, a connection to the internet and their own personal trading account with a forex broker such as BitMe.

Can you make it trading forex alongside companies, governments and central banks?

Open a demo account with BitMe.

Why trade Forex?

If you were to ask someone on the street what their opinion of forex trading was, you’d most likely get the following responses:

“Why on Earth would you want to throw your money away like that?”

“Your broker will steal your money.”

“You’re much safer investing in blue chip stocks for the long term.”

For one reason or another, forex is unfortunately seen by many as a risky, get rich quick scam. But is that a fair assessment? Well the answer is actually both yes and no.

Like most things in life, people fear what they don’t actually understand and if you don’t educate yourself and dive in head first with your life savings trading forex with an unregulated broker, what the heck do you expect? Of course you’re likely to lose your money…

On the other hand, if you put in the time to properly educate yourself as a forex trader, understand the leverage available to you, your broker’s financial regulation and most importantly how to manage your risk, then Forex could well be the perfect market for you to trade!

So what are some of the advantages that forex trading has over trading stocks and other markets?

Forex Trading is Easy

Unlike other forms of investing, forex trading is easy to get started. When you compare what you need to get started trading forex with what you need to get started in stocks, options or futures trading, they all pale in comparison.

All you need to trade forex is a computer, an internet connection and a mind that wants to learn! Open an account with a forex broker such as BitMe with as little as $100 and take advantage of the copious amounts of free forex education that is on the BitMe website!

Forex Trading is Cheap

As you just read, forex trading doesn’t require you to deposit tens of thousands of dollars into your account just to get started. You can open an account and begin trading forex with as little as a $100 deposit.

Another huge advantage that forex trading has over stocks, options and futures is costs to enter and exit a trade. With other financial instruments and markets, you can pay huge fees to simply enter and exit a one size fits all trade. Forex on the other hand allows you to trade just 0.01 of a standard lot, paying just the spread.

The Ability to Trade Forex Anywhere, Anytime

Unlike your 9 to 5 day job, forex trading doesn’t restrict you to your desk or worksite. If you don’t want to be inside, then don’t be inside! Forex gives you the ability to trade anywhere, anytime. Trade wherever and whenever you want, it’s up to you.

Access your MetaTrader 4 account on a computer, laptop, web browser, tablet or mobile phone. All you need is an internet connection. Always be connected to the market and never let a trading opportunity go by wishing you could have profited from it!

World’s Biggest Market

Here’s a question for you. How many stock charts have you looked at and seen gaps scattered throughout the chart?

Remember that gaps mean that you can’t get in or out of a trade at those prices because there is simply no one looking to buy or sell there. This adds a whole other element of risk to stock traders that forex traders don’t have to worry about.

The forex market is the biggest, most liquid market in the world. Get involved with a FREE $50,000 demo forex trading account and start your journey with BitMe today.

When Can I Trade Forex? Forex Trading Sessions

As we outlined in our what is forex section, the forex market is open 24 hours a day and 5 days a week. As one part of the world wakes up, the centre of trading focuses around that section of the globe and slowly shifts between financial centres as the day unfolds throughout the world.

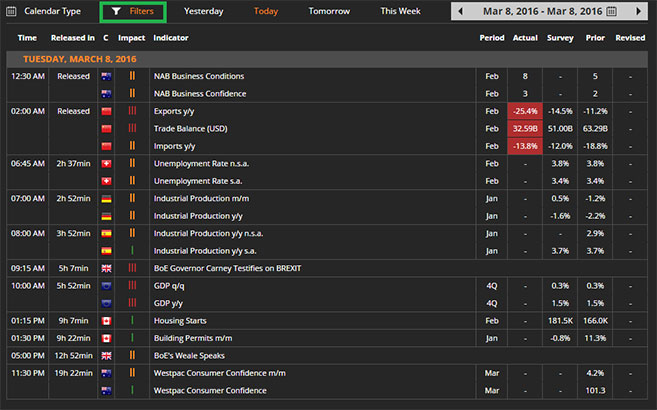

The major forex trading sessions are outlined in the following table:

| Forex Session |

Open (GMT) |

Close (GMT) |

| Sydney Session |

9.00 PM |

5.00 AM |

| Tokyo (Asian) Session |

11.00 PM |

7.00 AM |

| Frankfurt (European) |

7.00 AM |

3.00 PM |

| London Session |

8.00 AM |

4.00 PM |

| New York Session |

1.00 PM |

9.00 PM |

As a basic rule, you are better off trading the respective currency pair during its corresponding session. For example, AUD/USD is more likely to move during the relatively quiet Sydney session because of market moving news releases. On the other hand, EUR/GBP probably isn’t going to experience the same types of moves during Asia as both Europe and the UK is asleep.

Now, as you can see some of the forex trading sessions actually overlap one another. During these session cross over times, it is seen as one of the optimal times to be trading forex as you have highly liquid market conditions where good quality moves often come. But why are they seen as good quality moves? Shouldn’t a move be a move? Well the simple answer here is no, not all moves are good for trading.

For example, a move during the illiquid end to the New York trading session might be prone to a fake out rather than a sustained, more predictable move. You could be much better off taking a break out trade during the London session open when the market is at its most liquid and moves are better. On your forex sessions diagram, take note of important times such as session open and closes when major market participants might look to open or close major orders.

Download the MT4 Forex Market Sessions Indicator free here.

As with everything in forex, nothing here is actually set in stone. Just because a break out happens during the relatively quiet Asian session doesn’t mean that it will automatically be a fake-out like the textbooks may tell you.

Stay on top of forex session times and market moving news headlines with free access to the Forex News Terminal when you fund your live forex trading account with BitMe.

Overview

Forex currency pairs

Now we know a little more about what the Forex market is, let’s take a look at the currencies that are traded and how they are traded. We have talked about how massive the forex market is as a whole, so let’s now dig down a little deeper into the individual currencies that make up this huge market.

Below is a list of the most popular, actively traded currencies in the forex market as well as their abbreviations that traders use:

US Dollar (USD)

Euro (EUR)

Japanese Yen (JPY)

Pound Sterling (GBP)

Australian Dollar (AUD)

Swiss Franc (CHF)

Canadian Dollar (CAD)

But in the Forex market, you cannot simply buy or sell these single currencies alone. In Forex, currencies are actually quoted and traded in pairs, hence the name currency pairs. It makes sense when you think about trading currencies with real world applications and not simply as a paper share in a company or a futures contract. When you want to buy a specific currency, what are you going to pay for it with? Of course, another currency. This is where the idea of forex currency pairs comes from.

Here we have listed the most commonly traded forex currency pairs:

Euro / US Dollar (EUR/USD)

US Dollar / Japanese Yen (USD/JPY)

Pound Sterling / US Dollar (GBP/USD)

US Dollar / Swiss Franc (USD/CHF)

Australian Dollar / US Dollar (AUD/USD)

US Dollar / Canadian Dollar (USD/CAD)

The forex majors as shown on the BitMe MT4 Smart Trader Tools quote board.

Now let’s look at an example of a Forex trade. Say that your analysis is telling you to buy EUR/USD. This essentially means that you are buying the Euro and selling the US Dollar. Because each currency pair is actually a relationship between the two different currencies quoted, you have a few different scenarios that could put your trade in a profitable position.

Put simply, you will profit if the Euro rises and the US Dollar falls. But the currency pair relationship also means that you will profit if both currencies are rising but the Euro rises more and likewise if both currencies are falling but the USD is falling faster.

Be sure to log into your BitMe MT4 demo account and try both buying and selling different forex currency pairs to get your head around the relationships.

How are Forex Currency Pairs Written?

Here we can see the different parts that make up a forex currency pair.

The first currency listed in the pair is known as the base currency and the second currency listed in the pair is what’s known as the quote currency.

Have you ever noticed that a currency pair is always written in a set order? For example, EUR/USD is always written with the EUR as the base currency and not the other way around. This is due to standards that have been universally set, whereby each currency has a ranking relative to one another. If one currency is ranked higher than another, when quoted as a currency pair it will receive base currency status.

The universally accepted ranking order is as follows:

1. EUR

2. GBP

3. AUD

4. NZD

5. USD

6. CAD

7. CHF

8. JPY

The rankings were established according to the relative values of the currencies at the time, but new currencies such as the Euro were subjectively inserted.

When a forex currency pair is displayed as a quote like the example above, the price shows how much of the quote currency (in this case, the USD) is required to buy 1 unit of the base currency (in this case, the EUR). For example, EUR/USD at 1.2000 means that 1 Euro can buy 1.2000 US Dollars.

In a forex currency quote, the first number is what is called the bid price, or the price at which you are able to buy the currency pair. The second number is called the ask price, and is the price at which you can sell the currency pair. The difference between the bid and ask price is what is known as the spread and is the price that you must pay to enter your trade.

On the BitMe MT4 terminal, take a look at the quote board and check the base and quote currencies and the tight spreads that BitMe can offer its traders.

Forex Currency Pair Nicknames: Cable and Fiber?

Sometimes when talking to other forex traders you might hear a reference to a nickname that you don’t understand.

“I’m looking to long 10 lots in Cable, what are you thinking?”

“Hmm, have you taken a look at Fiber? Support looks like it might be breaking across the board.”

Wait, what? I thought we were talking forex trading over here? Although It may seem strange at first, these are actually nicknames for different forex currency pairs!

Let’s take a look at the two forex currency pair nicknames that get used the most, Cable and Fiber.

GBP/USD – Cable: Back in the mid-19th century, before the invention of satellites and fiber optics, the exchange rate between the British Pound Sterling (GBP) and the US Dollar (USD) was actually transmitted across the Atlantic Ocean via submarine cable. The first such cable between the London and NY exchanges was laid in 1858 and the rest as they say, is history!

Traders love to talk about the good old days and this piece of forex trading history has stuck with traders generations onward.

EUR/USD – Fiber: But what about the brand spanking new Euro that was first introduced in only 1999? EUR/USD of course doesn’t quite have the same romantic history to draw upon that Cable does. So what do traders do? Well, being the funny bunch that they are, they’ve gone and simply ‘upgraded’ the old Cable to a state of the art Fibre Optic line. Hence the nickname Fibre!

The nickname Fiber is simply a play on words on the first nicknamed Cable. Isn’t it funny how nicknames like this just stick!

Of course there are many more forex currency pair nicknames going around which we’ve listed for you here:

AUD/USD – Aussie

NZD/USD – Kiwi

USD/CHF – Swissy

USD/CAD – Loonie

GBP/JPY – Guppy

EUR/JPY – Yuppy

EUR/GBP – Chunnel

Can you figure out why they’re called what they are? Why not Tweet us @VantageFX and let us know!

Go through the Market Watch on your BitMe MT4 demo and find the currency pairs with nicknames yourself. You now never have to feel left out of a conversation with other forex traders again!

Types of Forex Currency Pairs: Majors v Minors v Exotic v Currency Crosses

You may have heard traders discussing the ‘majors’ or maybe even saw someone talk about shorting an ‘exotic’ forex currency pair. No they weren’t talking about a soldier trading from an exotic beach while sunbathing naked (zing!) on the sand, they were actually talking about the different types of forex currency pairs that are available!

The Majors are typically the most traded currencies, paired with the USD, although some traders may refer to any forex currency pair featuring the USD as one of the majors. The majors are the most actively traded forex pairs which means they most liquid. This increased liquidity means that forex brokers such as BitMe can offer tighter spreads between the bid and ask price on the majors. Here are the average RAW ECN spreads to look out for:

EUR/USD – 0.1 pips.

USD/JPY – 0.5 pips.

GBP/USD – 0.6 pips.

AUD/USD – 0.4 pips.

The Minors are normally referring to any of the remaining, non USD forex currency pairs. These slightly less popular pairs often experience more wild swings in both directions due to less liquidity in the market. This also means that their spreads are often wider than those of the majors. Here are the average RAW ECN spreads to look out for:

EUR/JPY – 2.1 pips.

EUR/GBP – 3.5 pips.

GBP/CHF – 3.3 pips.

AUD/NZD – 1.4 pips.

What about The Currency Crosses? Once again, the forex currency crosses are just another example of the minors where USD is no longer required to complete the trade. Historically you see, anyone who needed to trade one currency for another would first have to convert their original sum into USD. The currency crosses were first developed to bypass the step of first having to go to USD. While that sounds normal today, at the time this was ground breaking in its business functionality. Examples of a currency cross with RAW ECN spreads would be:

GBP/JPY – 3.1 pips.

EUR/AUD – 2.7 pips.

And finally, sometimes you may also see some of the minors referred to as The Exotics. This just simply means that the currency pair is something that is rarely traded or spoken about in mainstream financial circles. An example of some of the forex currency pairs that could be considered as exotics with RAW ECN spreads are here:

EUR/TRY

CAD/SGD

The characteristics of both majors and minors are different and the personalities of the currency pairs that you are trading have to be taken into account when you are determining the pairs on which to employ your trading strategy on.

Maybe the wider spreads on GBP/CHF might prohibit you from effectively scalping the pair? But at the same time, maybe the big moves might be much more effective for you as a swing trader? These are all things to consider when building your trading plan and deciding on which forex currency pairs to trade.

Test the 45 forex currency pairs that BitMe offers on a free MT4 demo account and test your trading strategy on different pairs.

Overview

Basics of Forex

In this chapter, we will discuss the basics of Forex trading – everything you need to know to get started trading.

First we will cover buying and selling in “Going Long and Short”, then we’ll move on to ‘Lot Size & Leverage’. Next, we’ll cover what a pip is and how to calculate its worth in “What is a Forex pip? How much is a Forex pip worth?”.

Finally, we’ll discuss the various order types and swap trading in “Different Types Of Forex Orders” and “What is Forex Swap? Can I Make Money Collecting Forex Swap?”.

Be sure to follow the lessons up with your own trading on a free $50,000 forex demo account.

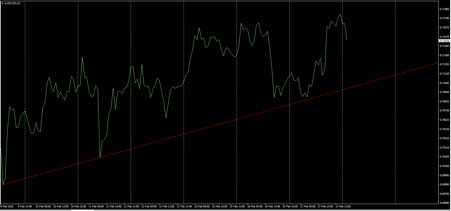

Going Long and Going Short

Put simply, forex markets go both up and down. Every regular guy you chat to on the street is going to be able to tell you that. So why do so many investors only buy and hold assets like shares in a company or commodities such as gold? What I find even more questionable, is why do these ‘buy only’ investors sell their assets when they know the market is going to go down, but don’t do anything else to profit from the move? They predicted it was coming, but they do nothing!

Wouldn’t it be great if instead of just selling your assets when you predict a fall in the market, you could profit from your prediction too? Forex trading isn’t like investing in stocks where you just buy and hold. Trading forex gives you the opportunity to profit in ALL market conditions. Whether the market is going up or going down won’t bother you as you’ll see trading opportunities in both directions.

As we described on the forex currency pairs lesson, when trading forex, you cannot simply buy or sell a single currency. In forex, currencies are written in pairs meaning that you must buy one currency pair by selling another (and vice versa).

If you want to buy a forex currency pair, then you are going long (or taking a long position). This means that you want the base currency to rise in value when compared to the quote currency so you can sell it at a higher price. This is straight forward, but what if you wanted to profit in a falling market?

On the other hand, if you want to sell a forex currency pair, then you are going short (or taking a short position). In this scenario, you want the base currency to fall when compared to the quote currency so you can buy it back at a lower price.

Try taking both long and short positions yourself on a BitMe MT4 demo account.

Lot Size and Leverage

When you’re trading forex online, it’s not like you can load your car up with cash, drive to a designated meeting place and trade your Dollars for Yen. You are of course doing business via online contracts. Contracts that have standard sizes called lots in place to make online forex trading standardised around the world.

The following is a list of common lot sizes and the corresponding number of currency units that you are in fact buying or selling.

- 1 STANDARD lot represents 100,000 units of currency.

- 1 MINI lot represents 10,000 units of currency.

- 1 MICRO lot represents 1000 units of currency.

Both the Standard STP and RAW ECN forex trading accounts at BitMe are by default set to be trading using standard lots. At first glance, this may seem like it is only suitable for big traders but don’t worry because the BitMe MT4 platform allows you to trade down to 0.01 of a standard lot, effectively giving you the opportunity to trade Micro lots if you please. By playing with fractions of a standard lot, traders of all levels are able to trade on a standard account.

The next question then becomes; do I need $100,000 in my forex trading account just to trade 1 single standard lot?! Don’t stress, the answer is no. This is where forex traders utilize what is known as leverage.

When you trade forex using leverage, you actually are able to control more money than the balance of your own trading account. The term comes about because with the broker’s help, you are ‘leveraging’ the money that you have. Using leverage allows you to increase your profits because you are able to trade bigger size than a non-leveraged investment would allow.

At BitMe, a standard account has leverage of 100:1. This means that for every $1,000 in your trading account, you are actually able to control $100,000 of currency. Think of leverage as your broker lending you the $100,000 so you can trade standard lot sizes. Your $1,000 account is what’s known as margin, and can be seen as a good faith deposit while you are using their money to trade standard lot sizes.

For example, let’s say your Standard STP trading account at BitMe has a balance of $5,000 and the leverage you are using is 100:1. If you wanted to go long 1 standard lot of EUR/USD then BitMe would set aside $1,000 as margin and would allow you to take the position.

This is an extreme example and also highlights the risks that leveraged forex trading exposes you to. If the ‘Margin Level’ in your MT4 Terminal drops to 50%, then your position will be automatically closed and you will have experienced what is called a margin call.

With leveraged forex trading, risk management becomes key. Use a forex demo account to help understand how to manage your risk while trading using leverage.

What is a Forex Pip? How Much is a Forex Pip Worth?

Manually Calculating Pip Value

In this article, Base currency refers to the first currency in a pair ie EUR in EURUSD and quote currency refers to the second ie USD.

TO CALULATE:

1) If account is denominated in USD and USD is the quote currency (EURUSD):

Pip Value = 0.0001 x Units

Example: You have a 5000 USD account and go long 25 000 EURUSD (.25 lots):

Pip Value = 0.0001 x Units

Pip Value = 0.0001 x 25 000

Pip Value = $2.50

2. If account is denominated in another currency (ie AUD) and USD is the quote currency (EURUSD)

Pip Value = 0.0001 x Units / AUDUSD

Example – You have a $5000 AUD account and you go long $25 000 EURUSD:

Pip Value = 0.0001 x Units / AUDUSD

Pip Value = 0.0001 x 25 000 / .7150

Pip Value = $2.50 / .7150

= $3.50

Note at current market rates, pip value is substantially larger if account is denominated in AUD – this is very important to know when calculating stop losses.

2) If account is denominated in USD and USD is the base currency (USDCHF):

Pip value = 0.0001 x units/quote

Example – You have a $5000 USD account and go long $25 000 USDCHF:

Pip value = 0.0001 x units / quote

Pip Value = 0.0001 x 25 000 / USDCHF

Pip Value = $2.50 / .9915

Pip Value = $2.52

3.) If account is denominated in another currency (ie AUD) and USD is the base currency (USDCHF):

Pip Value = 0.0001 x units / quote / AUDUSD

Example – You have a $5000 AUD account and go long $25 000 USDCHF:

Pip value = 0.0001 x units / quote / AUDUSD

Pip Value = 0.0001 x 25 000 / USDCHF / AUDUSD

Pip Value = $2.50 / .9915 / AUDUSD

Pip Value = $2.52 / .7150

Pip Value = $3.52

3) If account is denominated in USD and you are trading a cross with no USD component such as EURGBP:

Pip Value = 0.0001 x Units x Quote currency rate (GBPUSD).

Example: You have a 5000 USD account and go long 25 000 EURGBP (.25 lots):

Pip Value = 0.0001 x Units x GBPUSD

Pip Value = 0.0001 x 25 000 x GBPUSD

Pip Value = $2.50 x 1.4350

Pip Value = $3.59

If we used the above example but with an AUD account, we could either divide the final USD pip value by the AUDUSD rate, or use GBPAUD instead of GBPUSD as the quote currency rate.

Note that for a pair like EURCHF, the quote currency is not available as CHFUSD, therefore you would use 1/(USDCHF) for the quote currency rate. Also, with some pairs a multiplier other than 0.0001 must be used (if JPY is the quote currency for example, the multiplier is 0.01).

All too confusing? Try a BitMe RAW ECN demo account.

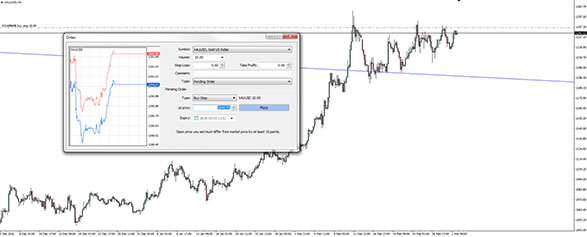

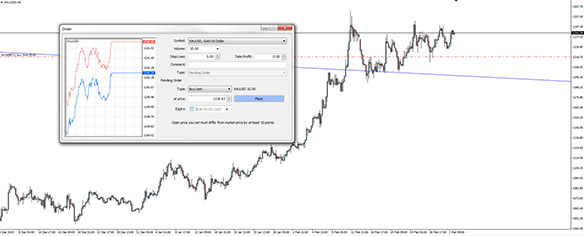

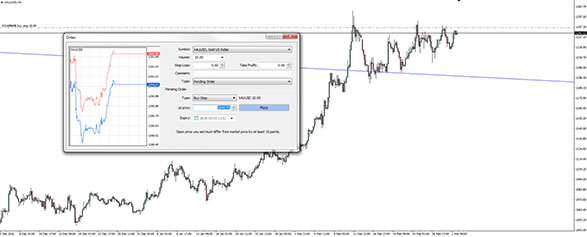

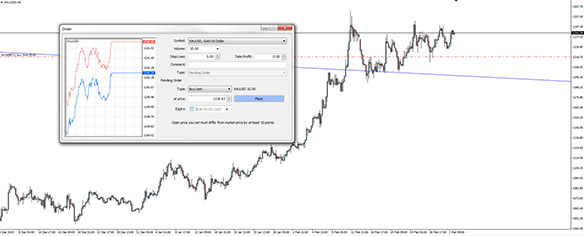

Different Types of Forex Orders

The term forex order simply means how you will enter or exit a trade. When you’re trading forex, you have many more options at your fingertips to take advantage of trading opportunities, both now and in the future, than just simply buying and selling at the current market price and we go through your options here.

A market order can be both a buy or sell order that will enter you into a trade at the current market price. That is the price you see right now on your MT4 chart. If you enter a market order then you will be instantly entered at the best available price.

Market orders are best used when you see a trading opportunity that needs you to act quickly. Click buy/sell at market and you’re in the trade instantly. For example, the bid price for AUD/USD is currently at 0.7228 and the ask price is at 0.7230. If you wanted to go long AUD/USD at market, then you would be entered at the ask price of 0.7230. You would click buy and your BitMe MT4 platform would instantly execute a buy order at that exact price.

A stop order can be both a buy stop, or a sell stop and is used when you would like to buy above the market or sell below the market. This is best used for trading breakouts or trend continuation strategies when you want the market to just keep going.

For example, AUD/USD is currently trading at 0.7230 and is trending upward. You believe that price will continue to go up, and actually break-out of resistance at 0.7300. Instead of sitting in front of your computer and hitting buy at market, possibly missing your perfect entry price, set a buy stop order at 0.7300. You don’t have to be in front of your computer when price hits your stop order.

If on the other hand, you think that price will reverse when it hits a certain price, you can use what is called a limit order. Limit orders can be either a buy limit, or a sell limit, depending on which way the market is headed before your expected reversal. A buy limit is used to by below the market and a sell limit is used to sell above the market.

For example, AUD/USD is currently trading at 0.7230 and your analysis tells you that resistance at 0.7300 will likely hold so you want to short if price reaches this level. You can either sit in front of your trading station and wait for price to hit 0.7300 and sell at market, or you can use a sell limit order.

The best way to understand the different types of forex orders are to use them under real trading conditions on a BitMe MT4 demo account.

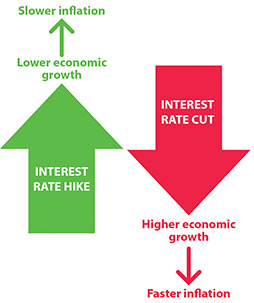

What is Forex Swap? Can I make Money Collecting Forex Swap?

What is swap in Forex?

Swap is an interest fee that is either paid or charged to you at the end of each trading day. When trading on margin, you receive interest on your long positions, while paying interest on short positions. The net interest difference is known as the carry and traders seeking to profit from this are known as carry traders.

Positive carry results when you receive more in interest than you are required to pay, and is added directly to your account. If the carry is negative, it is subtracted from your account. If you open and close a trade within the same day, the trade has no interest implications.

Can I make money from swap in Forex trading?

If you’re interested in placing a carry trade, the first step is finding a high yielding and low yielding forex currency pair. Some examples of low yielding (or funding currencies) are the Japanese Yen (JPY), the Swiss Franc (CHF) and the Euro (EUR). As far as high yielding currencies go, the Dollar (AUD) and New Zealand Dollar (NZD) are popular, though more advanced carry traders might look to the South African Rand (ZAR) or other exotic currencies.

Let’s use the Euro and Dollar: rates in the Eurozone are currently below 0, whilst interest rates in are relatively higher, currently 2%. This means that there is an opportunity to earn carry buying AUD with EUR ie going short EURAUD. Great, simple right?

Sadly it’s not that easy – there is no point earning a pip a day in swap if the pair is moving against you 100 pips / week. That is, if we wanted to perform a carry trade on EURAUD, we would wait until the pair was trending down, sell into any strength and hold for the length of the down trend.

Think of swap as an added bonus or incentive for holding a trade long term (or in the case of negative swap, a deterrent).

Are you looking to profit from the carry trade long term? Open a BitMe live account today.

How OIL Rollover Works

When you’re trading Oil on the MT4 platform, if you hold a position over the monthly expiration date of the futures contract that price is based on, you will encounter a rollover. If you do not wish for your position to be rolled over, then you should close your position beforehand.

This is because Oil is a futures contract which has a set expiration date. If you want to continue to hold your position over the expiration date, the old position must be closed as the contract expires, and a new one opened on the new futures contract.

Do I Incur Any Losses During the OIL Rollover Process?

Following the rollover in Oil, your account may show a materialised loss due to the process employed. Be aware that there are in fact ZERO costs or charges incurred by clients involved in the rollover process. Where you see a debit, you will also see an equal credit added to your account.

New Oil Price Old Oil Price = Debit for Long Positions / Credit for Short Positions

Oil Rollover Example

For a 10 barrel CL-OIL trade, at a price of $98.50 and a difference between monthly contracts of +50 Pips ($0.50), the calculations are as follows:

Long Position: (10 x -0.50) + (-0.04 x 10) + ((10 x 98.50 x -0.002 x 1)/360) = -$5.41

Short Position: (10 x +0.50) + (-0.04 x 10) + ((10 x 98.50 x -0.002 x 1)/360) = +$4.59

All Oil rollover adjustments are calculated in the currency that the instrument is denominated in. If your account is denominated in another currency, your account will be converted at the current market rate.

Trade Oil on MT4 with the leading, regulated broker, BitMe.

How to Avoid a Margin Call and Forced Closure

Forex traders have the ability to leverage a small amount of capital and open positions hundreds of times larger than their account balance, unlocking the door to incredible profits. Leverage however, is a double-edged sword: with great profit potential, comes the potential for large losses. If you open too large a position, or too many smaller positions, and the coin-toss goes against you, you could face a margin call and forced closure, leaving you with a small fraction of your original balance. So how can you avoid a margin call and forced closure?

Position Sizing

Safe, calculated position sizing goes hand in hand with successful forex trading. Before entering a trade, you should know where you are going to place your stop loss and how much you are risking on the position – how far your stop loss is from your entry and how much you are risking per trade determines the size of your position. It should never be the other way around: the size of your position should not determine your stop loss, or risk per trade.

Some education outlets and gurus will tell you that it is OK to risk as much as 5% per trade. Most professional traders on the other hand, will tell you this is far too much risk for a single position. Imagine you are trying to keep your drawdown below 20%: if you are risking 5% per trade and lose 4 trades in a row, you have already met your drawdown tolerance. The more an account draws-down, the harder it is it to build back up. Large drawdowns are also very tough on the mind and you could begin to revenge-trade or open even larger positions in order to try and make back your losses – this is not trading – it is gambling in every sense of the word.

In general, you should never risk more than 2% of your account balance on any one trade. If you are just starting out, 1% might be more appropriate. Once you have learned the ropes and you are confident with yourself and your strategy, then you could consider increasing your position size a little. Either way though, 5% is probably too much for the majority of strategies. Even the best professional traders can have losing streaks well in excess 4 trades.

If you want to trade larger positions, you should fund your account appropriately. This is the only safe way of trading with size.

Number of positions and correlation

The number of positions you have open determines your risk at any one time. Just because you are only risking 2% per trade, don’t think you can go crazy and open 10 simultaneous positions – this is a sure-fire way to receive a margin call.

Even if you only have two positions open, but you are trading highly correlated markets, you are still essentially risking 4% on a single trade. An example of this would be risking 2% on a long AUDUSD position, whilst simultaneously risking 2% on a long NZDUSD position – if the USD surges, you will be stopped out of both positions simultaneously, and lose 4%.

On the flipside, don’t take opposite trades in highly correlated markets and assume your risk is zero. If we take the above example, except you go long AUDUSD and short NZDUSD; yes the USD components theoretically cancel each other out, but you still have long AUD and short NZD exposure. Also, correlated markets don’t always move in lockstep and in times of high volatility, the market can move violently in both directions in just a few minutes and take out both of your stops.

In general, you should never have more than two or three positions open at the same time, and you should try to avoid trading highly-correlated markets, or at least be aware of the risks.

Margin call and forced closure

If the equity in your account falls below 100% of your margin requirements, you will receive a margin call (in modern times this is just an email – no one will physically call you!). The margin call is informing you that you have insufficient equity in your account and you should either close some of your positions, or top-up your account with appropriate funds. You can close, or partially close your positions from your MT4 terminal, or log into your client area and top up your account with a credit card, or one of our other instant funding options.

If you ignore the margin call warning and your equity continues to fall, reaching 50%, your positions will be automatically closed and your floating losses will be realized. This is what’s known in trading circles as a ‘blown account’ – you will be left with a very small portion of your original balance. Exactly how little you are left with depends on how much leverage you were using and how many positions you had open. If you have lots of positions open, they won’t all be closed simultaneously, but progressively. This means you could be left with only a few dollars in your account. Blown accounts must be avoided at all costs.

It’s all on you

Though we can educate you in regards to proper risk management and notify you when your equity falls too low, at the end of the day, managing your position sizing and ensuring your account remains sufficiently funded, is your responsibility. BitMe offers clients large amounts of leverage so our clients are free to trade in a manner that suits them and trade any strategy. Most scalping strategies for example, require large amounts of leverage, even when they are only risking 1 or 2%. If you are not scalping, chances are you don’t actually need a lot of leverage – consider setting your leverage to 50:1 or 100:1.

Leverage is an incredibly powerful tool if used correctly, but with great power, comes great responsibility, and that responsibility lies squarely with you.

The upside

If you trade with an appropriate amount of leverage, restrict your risk-per-trade to no more than 2%, size your positions appropriately and never open more than a couple of positions at any one time, it is nearly impossible to receive a margin call. Proper risk management is the difference between successful trading and gambling. Perfect risk management and you will be well on the path to becoming a profitable and successful forex trader.